Business vehicle depreciation calculator

Diminishing Value Method for Calculating Car Depreciation. If youd rather figure out things by hand use this equation.

Depreciation Rate Formula Examples How To Calculate

Auto depreciation calculator Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years.

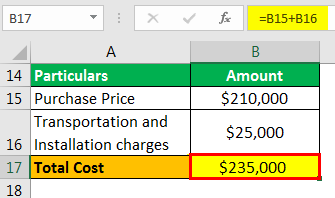

. 8 Methods to Prepare Depreciation Schedule in Excel 1. Alternatively if you use the actual cost method you may take deductions for. Under this method the calculation of depreciation is based on the fixed percentage of its cost.

Value of the Car when Purchased. The formula for depreciation rate is 1- salvage value WDV as on 31032014 1 remaining period of useful life100. Depreciation formula The Car Depreciation.

This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used. SLD is easy to calculate because it simply takes the. Based on user-provided data the.

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. May 04 2020 To figure out how much you can deduct you can use a handy depreciation calculator. This calculator is for.

Aug 24 2022 If you use this method you need to figure depreciation for the. D i C R i. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

If a vehicle is used 50 or less for business purposes you must use the straight-line method to calculate depreciation deductions instead of the percentages listed above. The percentage of bonus depreciation phases down in 2023 to 80 2024 to 60 2025 to 40 and 2026 to 20 Accumulated depreciation is the total decrease in the value of. SUVs with a gross vehicle weight rating above 6000 lbs.

You probably know that the value of a vehicle. Adheres to IRS Pub. To find out how much motor vehicle depreciation you can claim contact BMT on 1300 728 726 or Request a Quote.

Are not subject to depreciation including bonus depreciation limits. Basis of your car. Im dealing with a.

They are however limited to a 26200. 510 Business Use of Car. If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead.

D i C R i. The MACRS Depreciation Calculator uses the following basic formula. Free MACRS depreciation calculator with schedules.

Where Di is the depreciation in year i. Supports Qualified property vehicle maximums 100 bonus safe harbor rules. The calculator incorporates section 280F depreciation limitations and lease inclusion amounts for a vehicle put into service during the 2000 tax year.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. C is the original purchase price or basis of an asset. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment.

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

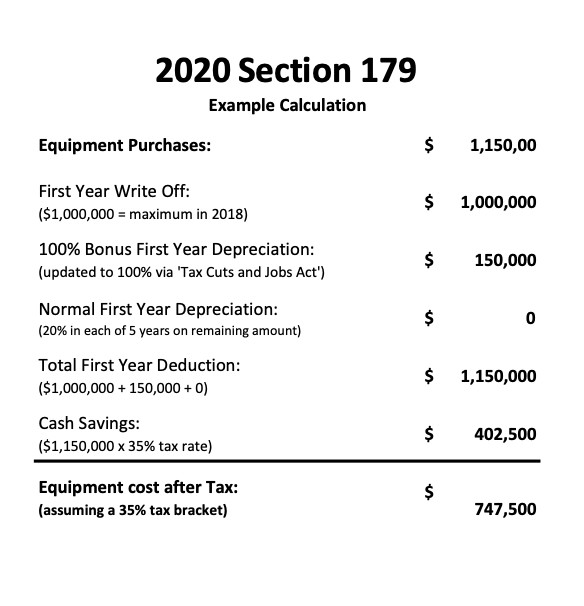

2020 Section 179 Commercial Vehicle Tax Deduction

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Calculator Outlet 53 Off Vetlabprodaja Com

Annual Depreciation Of A New Car Find The Future Value Youtube

Auto Finance Calculator With Trade Fresh Car Depreciation Calculator Calculate Straightline Car Payment Calculator Car Payment Car Loan Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Vehicles Atotaxrates Info

Depreciation Formula Calculate Depreciation Expense

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Macrs Depreciation Calculator Irs Publication 946

Free Macrs Depreciation Calculator For Excel